Supplemental Security Income

Supplemental Security Income (SSI) is a federal assistance program that provides financial support to low-income individuals who are aged (65 years or older), blind, or disabled. SSI is administered by the Social Security Administration (SSA) and is designed to ensure that individuals with limited income and resources can meet their basic needs. It is NOT the same as Social Security Disability Insurance (SSDI), which is based on an individual's work history and contributions to the Social Security system, SSI is a needs-based program. Eligibility for SSI is determined based on income and resources, including financial assets, property, and other forms of support. The program takes into account both the individual's income and the value of their resources to determine eligibility and the amount of benefits they may receive.

An individual with a disability can apply after turning 18 years old.

Eligibility for SSI includes automatic eligibility for Medicaid.

*for more information, click the icon

To apply for SSI, individuals must meet the program's eligibility requirements, complete an application process, and provide necessary documentation to the SSA. The application process typically involves an interview and a review of the individual's financial situation. If approved, SSI benefits are typically paid on a monthly basis. The monthly benefit amount for SSI is set by the federal government and may vary from year to year. It's important to note that SSI is a federal program, but certain states may supplement the federal benefit with additional funds, increasing the overall benefit amount for eligible individuals within those states.

**It is always recommended to contact the Social Security Administration or visit their official website for the most up-to-date and accurate information regarding SSI eligibility, benefits, and application procedures.

-

Call to make an appointment at 1-800-772-1213 (between 8:00 a.m. – 7:00 p.m., Mon - Fri)

Use the Get Started online tool to request an appointment

Contact your local Social Security office

-

Make sure no more than $2,000 is in any account with your child's name

Housing Agreement

-

Copy of IEP

List of services provided to your child and their contact information including:

Any evaluation(s) within the last 1-3 years from any health practitioner such as speech, occupational, and/or physical therapist(s)

doctor's notes

documents from any waiver your child is currently in (e.g. autism waiver)

Social security card or number

Birth certificate

Bank statements for any checking or savings accounts (including ABLE accounts)

Rental agreement (including at least three prevailing rents in the area)

If it's a young adult under guardianship, any associated paperwork

-

If the social security office decides they need more information to determine eligibility, they may send your child to a doctor selected by them

The Social Security office will send a report to the child's school and doctor to be completed

A final determination will be made and a letter will be sent about approval or denial

-

Contact the Department of Social Service to apply for Medical Assistance for your child

The Representative Payee begins tracking payments

-

You can appeal the denial

Social Security will provide information about how to file an appeal in the denial letter

More information can be found here

Representative Payee

What is it?

If Social Security determines your child will not be able to manage their monthly checks, they may require a Representative Payee (Rep. Payee). A parent can be named their child’s designated payee at the appointment.

What does the Representative Payee do?

The Rep Payee needs to keep track of how SSI funds are spent and report this to Social Security annually.

How much will my child receive?

Approximately $794 a month

If a person doesn’t pay for food and shelter, the most SSI they can receive is $500

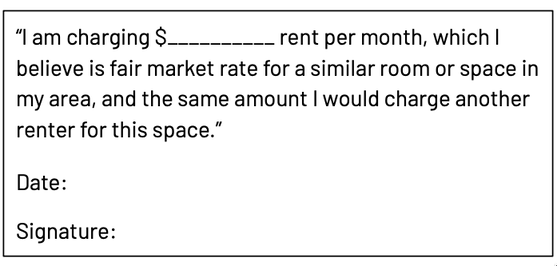

A Housing/Rental Agreement can help prove food and shelter is being paid for

How does the Representative Payee track expenses?

An annual form will be sent from Social Security to document expenditures. When tracking on a monthly basis, you will want to create a spreadsheet or worksheet to use. You will only need to separate out what was spent on food and shelter, what was spent on everything else, and what was saved

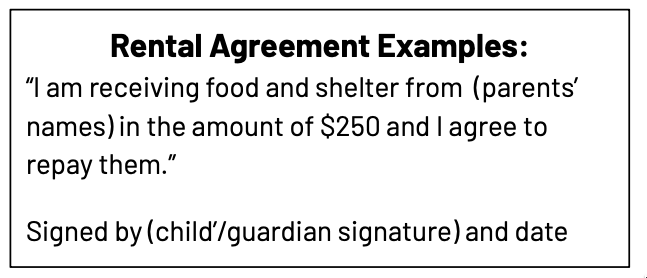

Housing/Rental Agreement

Why do I need one?

Free room & board will be counted as a source of income for your child, which in turn will lower the monthly SSI payment they receive.

How do I make an agreement?

If the child lives with family, he/she/they must pay their share of household food and shelter costs (i.e. if the family includes 4 people, the person would pay 1/4)

You can find market rates for room rentals in your area on Craigslist

Write up this agreement so that it is in place before the SSI appointment

Intending to pay rent?

If your child is not yet paying rent, but you intend to have them start paying as soon as their SSI check comes, you can show the Social Security worker your rental agreement, state their intention to start paying rent and the location where they will be renting

Adult Disability Report Checklist

It helps if you are well prepared before you start to fill out the forms for SSI. In order to fill out the necessary forms, you will need to gather a list of all services provided to your child, including the following:

Any Emergency Room visits

Any Hospitalizations

Treating doctors/psychiatrists

Treating therapists, counselors, and/or social workers

Any school services (IEP)

School name

Any Neuro-psychological or other testing

Names of medications

Start with the most recent services and providers and go back in time for the history.

Then you will need to locate:

The names, addresses and contact information of each provider that provided the service

The dates that your child received services from the providers

Online Video Supports &

Additional Resources

Understanding SSI

SSI & SSDI for Young Adults with Disabilities with Michael Dalto

YouTube playlist

A Guide for Representative Payee(s)

Link to original file is here (type “A Guide for Representative Payees” in the search bar)

What is Supplemental Security Income?

(The Post-Secondary Transition Podcast Ep. 21)

Avoiding SSI Reductions

Link to original file is here